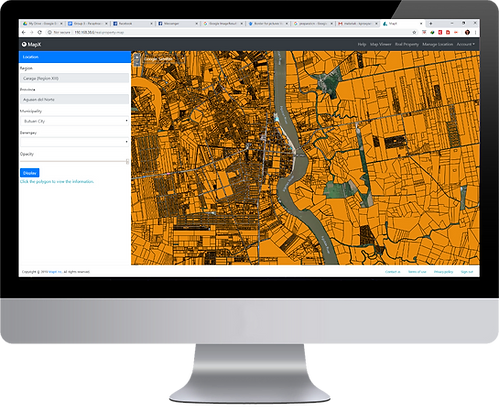

MapX: Manage Your Assets, Properties and Map It For Visualization

Technology for Real Property Mapping and Assessment at Your Fingertips

MapX is a complete real property mapping and assessment solution that uses advanced geoinformatics technologies. Our company is a product of innovation and extensive research in spatial mapping, and visualization and interactivity for high-end mapping services. We endeavor to improve efficiency in the current process of administering real property tax mapping by harnessing the power of modern technologies.

Today, we bring you MapX! Your convenient and hassle-free real property solution made available at the tips your hand.

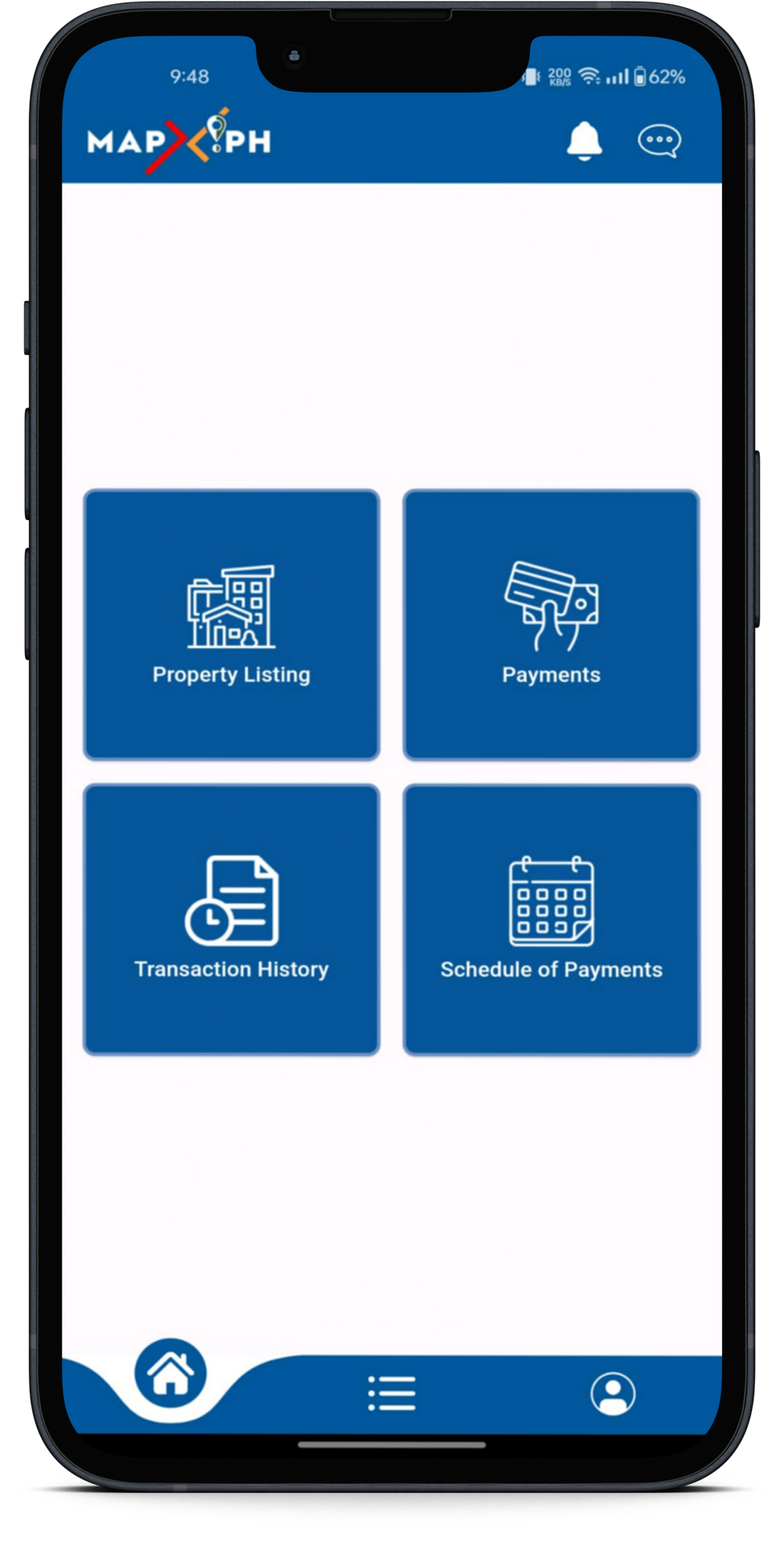

Payment Feature

Experience seamless transactions with our mobile app's integrated payment feature.

Property Listing

Worried having more than one land asset? We got you covered. Our mobile app enables the user to list and tag the location of its assets for easier and faster tax mapping.

Real-Time Notification

Receive timely notifications and reminders to track and manage your property tax obligations with ease.